Financial Analysis of Walmart

Published October 20, 2020 | Author: PenMyPaperKey Points

- Walmart is the biggest revenue generating company, with USD 572.75 billion on 2022.

- Despite the high revenue, the company has seen low operating margin over the years.

- The retail giant has also been operating with low profitability compared to other market players.

Walmart is one of the biggest multi-brand retailers in the world, which is known for its gargantuan operations across 26 countries. Over the years, it has been able to create a strong brand image around the key value proposition of being an everyday discount store. The success of Walmart is reflected on its massive revenue generation year after year. The retail giant has earned a revenue of USD 570 billion in the year 2022(Q1), placing itself in the 1st rank in the Fortune 500 list. In fact, Walmart has been the leading revenue generator for 10 consecutive years. This article primarily focuses on shedding some light on the financial analysis of Walmart.

Walmart Financial Analysis

A close look at the financial statement of Walmart reveals that the company has shown a significant increase in revenue generation over the years. However, it has been also found that the net income of the company has fluctuated a lot over the past decade. In fact, it has taken a sharp dip in the years 2018 and 2019. Regardless, Walmart has managed to recover in the following years. It should be noted that even though a company, as big as Walmart is earning a lot of revenue, does not essentially mean that the company is making profits.

Year |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

Revenue USD Mil |

469,162 |

476,294 |

485,651 |

482,130 |

485,873 |

500,343 |

514,405 |

523,964 |

559,151 |

572,754 |

Gross Margin % |

24.9 |

24.8 |

24.8 |

25.1 |

25.6 |

25.4 |

25.1 |

24.7 |

24.8 |

25.1 |

Operating Income USD Mil |

27,801 |

26,872 |

27,147 |

24,105 |

22,764 |

20,437 |

21,957 |

20,568 |

22,548 |

25,942 |

Operating Margin % |

5.9 |

5.6 |

5.6 |

5 |

4.7 |

4.1 |

4.3 |

3.9 |

4 |

4.5 |

Net Income USD Mil |

16,999 |

16,022 |

16,363 |

14,694 |

13,643 |

9,862 |

6,670 |

14,881 |

13,510 |

13,673 |

Source: Morningstar

The operating margin of Walmart has declined over the years, despite gradually increasing revenue. The reduction in the operating margin of Walmart can be discussed in the light of its operating expenses. As revealed from the financial report of the company, the increase in operating expenses have had a significant impact on the declining operating margin.

Financial Health

The financial health of Walmart can be assessed using the financial ratios.

The Current Ratio of the company as of 2022 has been recorded to be 0.93. This ratio is below 1, which may suggest that the company may have some issues in meeting its short term obligations and liabilities.

The Quick Ratio of Walmart, recorded for 2022 is 0.26. Since, it is far below 1, so it can be stated that the company has very poor liquidity. It is likely to face a lot of challenges to meet its obligations using the available liquid assets. It also suggests that Walmart is heavily reliant on its inventories.

The Debt/Equity Ratio, as of 2022, is 0.63. It suggests that the company is not borrowing too aggressively to fund its expenses. The ratio of 0.63 indicates that Walmart is rather on a safe zone, and a large portion of its expenses comes from its equity. A higher D/E ratio would suggest that the company is likely to face additional interest expenses.

Profitability

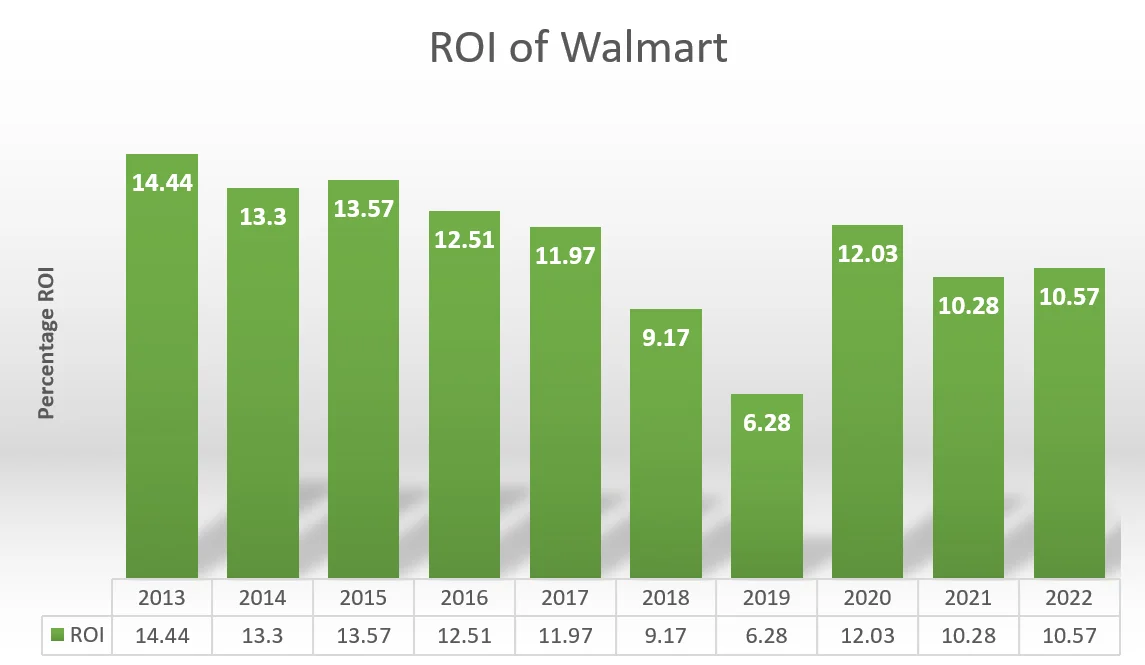

The profitability of Walmart can be assessed by analyzing the Return on Invested Capital (ROI). As of 2022, Walmart is operating with an ROI of 10.57%. Compared to other discount retailers in the industry such as Target (ROI: 21.7%), Costco (ROI: 21.4%) and Macy’s (ROI: 19.7%), Walmart has a significantly lower return on Investment. However, when compared with the e-commerce gaint Amazon (ROI: 7.1%), Walmart has performed better. It should also be noted that the ROI of Walmart has fluctuated quite a lot over the past decade, with a lowest dip in 2019 (6.28%), however it has improved significantly in the next year to 12.03%.

Summing it Up

To sum it up, Walmart has been able to stay in the leading position in terms of revenue generation. But it has been revealed that the operating margin of the company is low, owing to the high cost of operations. Moreover, it has been also found that the company lacks liquidity, and may not be able to pay-off its liabilities with its liquid assets. However, at the same time, the company is less reliant on loans as most of the expenses are funded by its equity. When it comes to profitability, Walmart has operates with only moderate profitability, but it is much lower than that of the rival brands like Target, Costco, etc.

Professional Assistance from Experts

Still struggling with your financial analysis paper? Hire a professional to help you out. At PenMyPaper, our experts are always ready to write any paper for you, even in extremely short deadines. We ensure completely plagiarism free papers, across any subject domain. Feel free to talk to us, to know more about our services.