Analysis of UK Coffee Industry

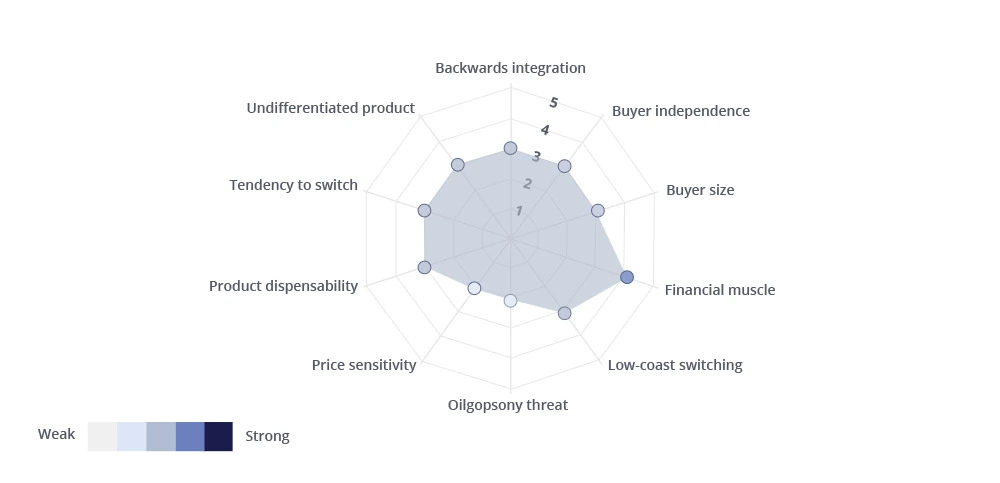

Published October 27, 2020 | Author: PenMyPaperBuyer Power

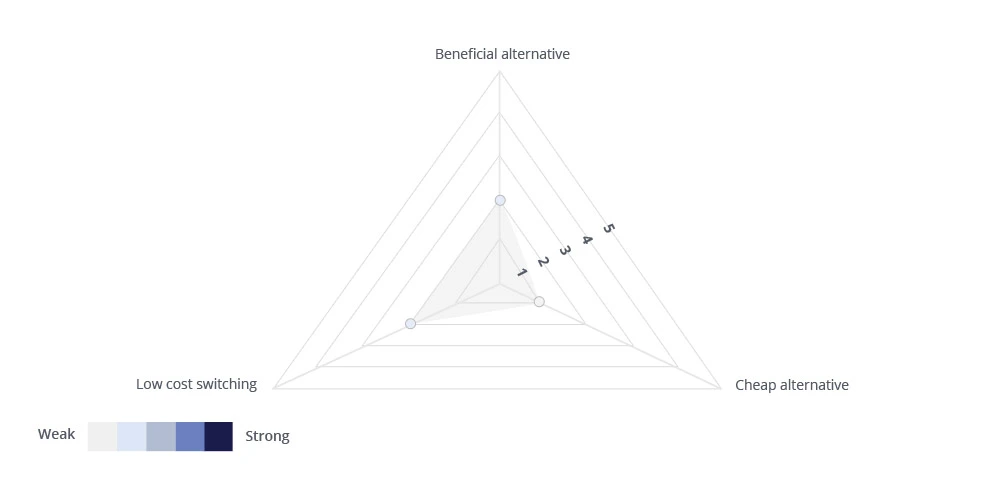

In UK, distribution channels for coffee market are complemented by hypermarket and supermarkets (covering 79.7% of market volume). British customers prefer tea more than coffee products hence companies selling coffee faces challenging situation to alter taste bud of local customers. The coffee industry is associated with low switching cost and product differentiation, which increases buyer power up to certain extent. Homemade coffee shops and motorways stations act as alternate retail channel for hot drinks market in the industry. Overall, buyer power can referred as moderate in UK hot drinks market.

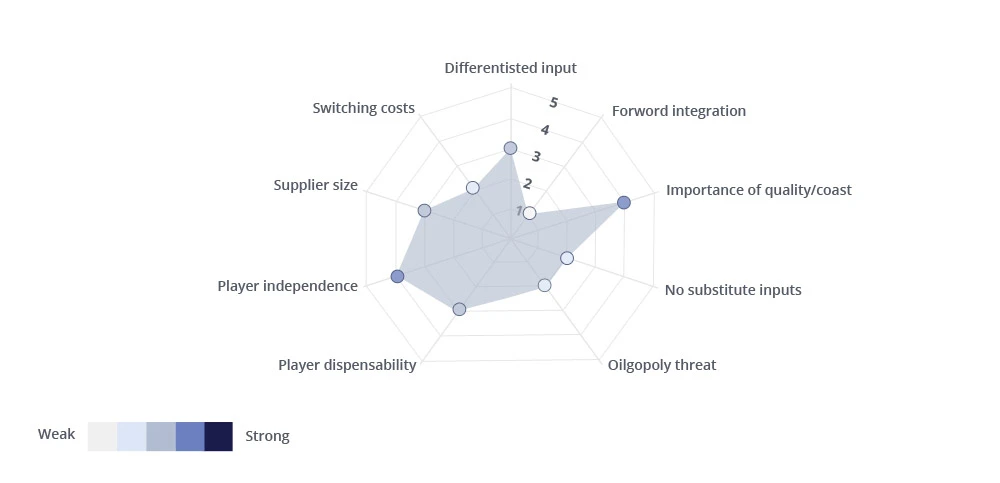

Supplier Power

Major supplier companies selling hot drinks are farmers harvesting coffee beans and cocoa seeds. Suppliers are largely located in various countries such as Africa, Latin America and South Asia. Various factors such as poor economic condition of suppliers, presence of large number of independent farmers and undifferentiated nature of coffee beans decreases bargaining power of suppliers up to a significant extent. Meanwhile multilevel supply chain of large coffee retailers is complemented with inclusion of intermediaries, decreases earning potential of individual farmer. Overall, supplier power in UK hot drinks market is estimated as low medium.

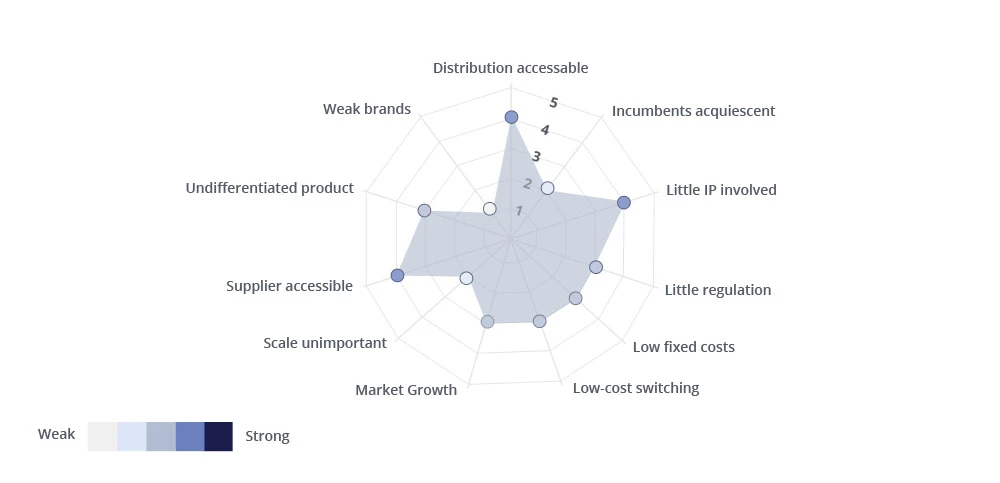

Threat of New Entrants

New entrants in UK hot drinks market try to distinguish their offering by emphasizing taste, health benefits and quality of coffee bean. Low switching cost for customer enhances market opportunity for new players. Brand equity of companies like Starbucks can create significant competition barrier for new entrants. Leading players in the market use economies of scale in order to create paradigm shift in market equilibrium and achieve competitive advantage over new entrants. Established brands such as Starbucks offer a wide range of coffee product portfolio to customers, which further decrease product differentiation scope for new entrants. Overall, it can be inferred that threat of new entrant is moderate in the country.

Threat of Substitutes

Tea and coffee are the most popular hot drink products in the country. Coffee plays crucial role on creating cultural heritage of UK, decreasing threat of substitute products. Although consumers prefer to take functional drinks over traditional hot drinks in order to prevent caffeine intake but their number is too small to perturb market equilibrium. Hence, overall threat of substitute is assessed as very weak.

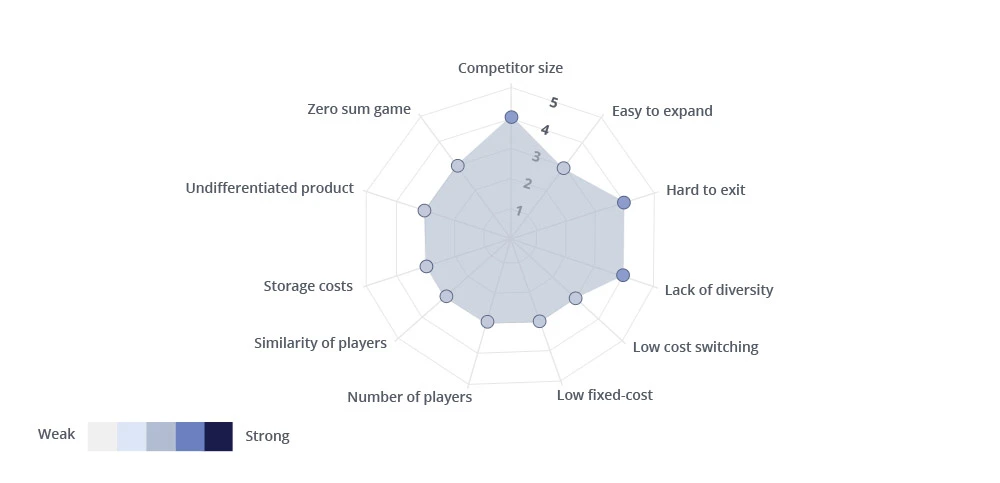

Degree of Rivalry

Hot drinks market in the country is fragmented because due to presence of any clear market leader. The degree of rivalry is complemented with low switching costs, limited scope of product differentiation and high start up cost. High exit costs can be classified as important factor for increasing market fragmentation. Existence premium coffee brands like Lavazza and Senseo increases dynamics of business competition in the market. Overall, competitive rivalry for UK hot drinks market is assessed as high medium.